Get Tax Wise and Ready for Change in Retirement

Get Tax Wise and Ready for Change in Retirement

A Flintstones Primer for Retirees on Taxes

Our friends in Washington just announced a new proposal to make the tax code simpler and better for everyone. Sounds like a monumental task. Let’s hope they can pull it off (without clubbing each other over the head and making the tax code worse).

Before you make like Fred hollering for Wilma, stressing out about how these changes might affect you and your finances in retirement, it’s a good idea to sort through the rubble and crunch some numbers. To get ready for changes, the best place to start is reviewing your current tax situation.

REVIEW YOUR CURRENT TAX SITUATION

Most of us need to understand two key components of our taxes so we can make smart financial decisions: tax brackets and filing status.

Tax brackets. Individual taxpayers currently fall into one of seven brackets, depending on taxable income: 10%, 15%, 25%, 28%, 33%, 35% or 39.6%. Because the U.S. tax system is progressive, not all your income is taxed at the same rate. Instead, like putting pebbles into different buckets, the first segment of your income is taxed at 10%, income above that bracket threshold is taxed at 15%, and above that bracket threshold, 25% (and so on). Therefore, as you will see in the illustration below, your actual average tax rate across all your income is far different than your top tax bracket.

Filing status. Tax-bracket thresholds change for joint filers and single filers. For the same amount of income, a single filer will pay taxes at a much higher rate than a married couple filing jointly. This reality has a big impact on recently widowed or divorced couples who had enjoyed the benefit of joint filing and, now, suddenly become single filers. (If you’re an old dinosaur who has never been married and never will be, this change, of course, won’t apply to you.)

PREPARE FOR CHANGE

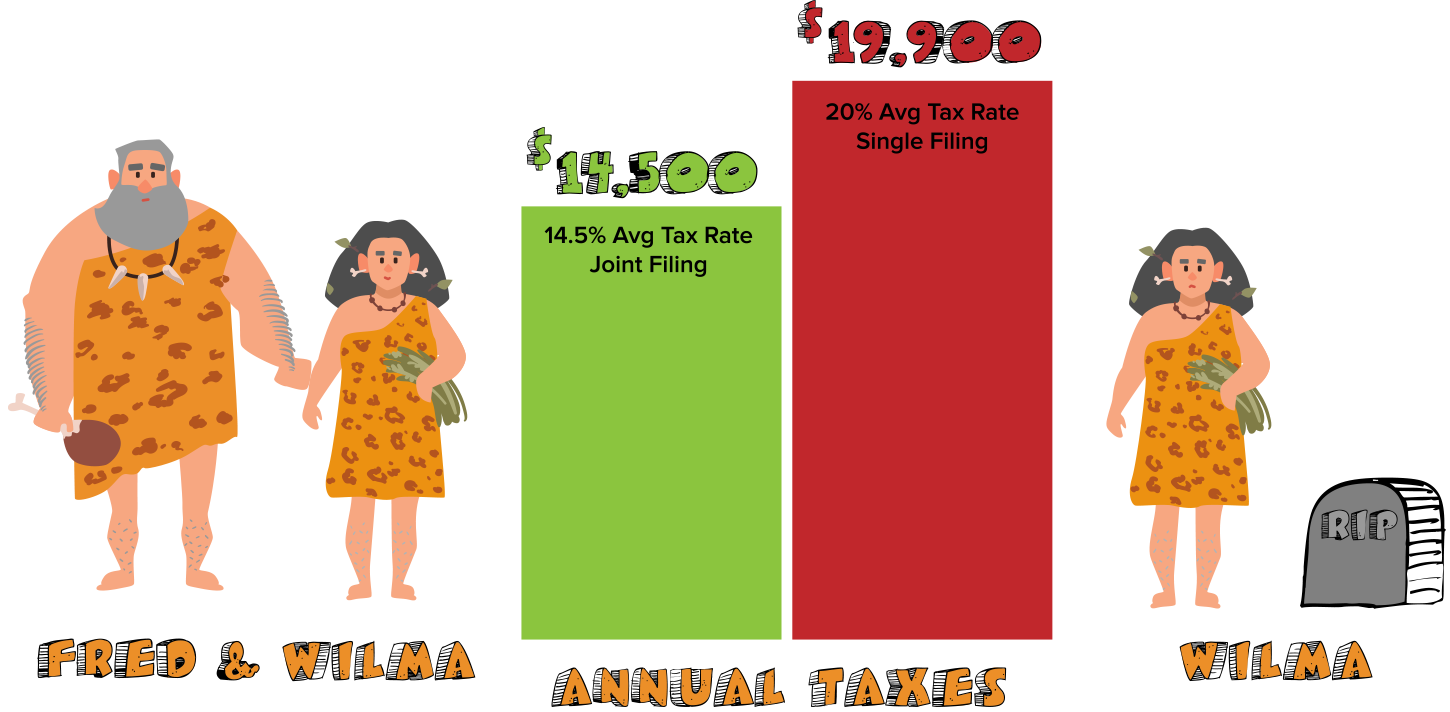

To see how these two factors work together, let’s look at a Fred and Wilma’s tax status. Fred retired from his rock quarry job on solid footing. After all deductions, Fred and Wilma’s assets give them a nice $100,000 in taxable income. At that amount, their joint-filing tax bracket is 25%, and their total federal tax will be around $14,500. So, their average tax on all income is only 14.5%, not 25%, because of the progressive tax brackets.

But if Fred should die and Wilma’s taxable income stays the same at $100,000, she would find herself—as a single filer—in the 28% bracket. Her total federal tax bill jumps by 37% to $19,900, instead of the $14,500. This new rate is a 20% average tax on all income. She might be better off having more income coming from nontaxable sources at this point, to reduce her tax bill to a number closer to what it was before.

WHY BEING TAX WISE MATTERS

Will the tax code change? Will your tax status change? As sure as Fred and Barney will jump in their car and take off with foot power, yes!

The unanswered questions are “when and how?”

Understanding your tax status as it is now—and how it could change—will help you make smarter decisions both now and in the future. It will inform you about when to take deductions, how to manage taxable and non-taxable income sources, and the need to plan for filing status changes.

I suggest that you review your latest tax return and do some quick research on tax brackets, filing status, and where your financial situation fits into those thresholds. Having a handle on this knowledge is the best way to enter retirement and your senior years. You must assume some things will change.

They always do.

Even for old dinosaurs.

____________

Andy Raub is known as “America’s Encore Coach” because of his passion to help retirees repurpose their lives and reorganize their money. An early Baby-Boomer, he has been a financial advisor for 35 years, bald for 40 years, and husband to Jean for 49 years. Andy has the skill of a teacher, the insight of a writer, and the heart of a coach. He is “Dandy” to four teenage grandchildren, Dad to two daughters, and irritant to two sons-in-law. Andy is the author of the new book The Encore Curve – How to Retire with a Life Plan That Excites You and the founder of the Encore Curve Program. See how The Encore Curve process can help clarify your life and simplify your money at EncoreCurve.com.